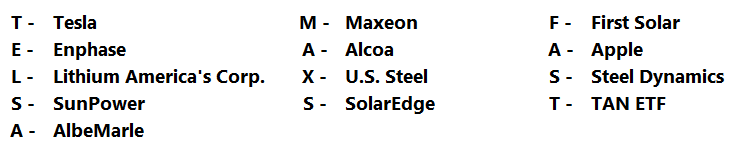

TESLAMAXSFAST ™

TESLAMAXSFAST™ is an investment theme and acronym coined by NEO for the following publicly traded companies and ETF (Exchange Traded Fund) he believes are well-positioned to capitalize on the explosive and long-term exponential growth opportunities in the new Trinity era:

TESLA (TSLA) is the only Company leading the world’s future for both transportation and energy independence. They are the world’s only fully vertically integrated Company whose complementary suite of product solutions benefits consumers on a global scale which in turn benefits Earth on a global scale the most via the Energy Trinity framework. As such, Tesla’s energy ecosystem combination of Electric Vehicles, Solar, and Battery Energy Storage solutions makes it the only Company best positioned to exponentially capitalize as hundreds of millions of consumers around the world transition towards new electric vehicles and energy independence. Elon and Tesla consistently challenge the status quo on every level encompassing engineering, software, supply chains, and manufacturing. This spirit and execution has disrupted multiple industries across the globe and will continue to do so for the foreseeable future. If you have ever wondered why Tesla commands such a high multiple relative to future earnings, these are just a few of the known dynamics. Remember, Solar has been missed by everyone from Mainstreet to Wall Street, legacy automakers and current EV only pure plays. Solar unlocks tremendous hidden value in Tesla. Regardless, our guess is after reading Decoding Elon Musk’s Secret Master Plans and the Electric Vehicle and Solar Savings Multiplier debuts, many Wall Street analysts will suddenly be hiking their price targets on Tesla. The same can be said about the TESLAMAXSFAST investment theme.

ENPHASE (ENPH) sells home energy solutions for the solar photovoltaic industry in the United States and internationally. With over 400 patents and pending patent applications filed around the world, Enphase Energy is a global leader in patent filings covering renewable energy technology. Its patented microinverter technology for solar panels has revolutionized the solar industry with their technology. Microinverters convert direct current (DC) solar panel energy into an alternating current (AC) which is the form of electricity used around the world. As of December 31, 2021, Enphase has shipped more than 42 million microinverters, and approximately 1.9 million Enphase residential and commercial systems have been deployed in more than 130 countries.

SUNPOWER (SPWR) was founded in 1985 by Stanford Electrical Engineering Professor Richard Swanson. With over 35 years of dedicated solar experience, SunPower is the only U.S. based solar company that’s been around longer than their 25-year product warranty with their end-to-end fully integrated solar energy solution. They currently have exclusive access to the world’s highest efficiency solar panels featuring SunPower Maxeon cell technology. SunPower has received more than 1,000 patents for its solar innovations. SunPower has a distribution and product platform to scale exponentially due to forthcoming robust solar demand.

LITHIUM AMERICA’S CORP. (LAC) a white lithium diamond in the rough…a really rough, rough one at that. Lithium America’s Corp is actually a Canadian-based resource company focused on the advancement of two significant lithium projects: the Cauchari-Olaroz project (“CauchariOlaroz”), located in Jujuy Province, Argentina, and the Thacker Pass project (“Thacker Pass”), located in northwestern Nevada, USA. Geologists estimate that Nevada could potentially hold 25% of the world’s lithium supply. However, the Company to date, has not generated significant revenues and has relied on equity and other financings to fund operations. The underlying values of exploration and evaluation assets, property, plant and equipment and the investment in Cauchari-Olaroz project are dependent on the existence of economically recoverable reserves, maintaining title and beneficial interest in the properties, and the ability of the Company to obtain the necessary financing to complete permitting and development, and to attain future profitable operations. Will Nevada yield white lithium diamonds?

ALBEMARLE (ALB) is currently the world’s largest lithium producer for Electric Vehicle batteries. Lithium, the main materials component in EV batteries, is not considered to be rare. However, Albemarle mines a significant amount of lithium from two world-class mines. One is located in the Salar de Atacama (Chile), and the other one in Clayton Valley near Silver Peak, Nevada (USA).

MAXEON (MAXN) is a spin-off from SunPower and headquartered in Singapore. Maxeon is well-positioned for the world’s global solar stage. Their patented Maxeon solar technology was built from over 35 years of boundary-pushing solar DNA, making them a global leader in solar innovation and efficiency. Maxeon Solar Technologies designs, manufactures, and sells advanced SunPower-branded solar panels to customers in more than 100 countries worldwide through a global network of more than 1,200 sales and installation partners.

ALCOA (AA) specializes in aluminum and is the world’s sixth-largest producer of aluminum. A tremendous amount of aluminum will be needed by hundreds of millions of consumers seeking solar energy systems which use aluminum in solar panel racking and framing. Additionally, aluminum is needed in a lot of Tesla’s as they are made with a blend of aluminum and high-strength steel.

U.S. STEEL (X) Wait where’s the X? U.S. Steel’s stock ticker is “X” and it is the 8th largest producer of steel in the world. Their trademarked XG3 steel is the most advanced of Advanced High Strength Steels (AHSS) in the automotive market today. It incorporates an optimum strength-to-weight ratio for improved safety and fuel efficiency; superior formability for winning style and lower per-vehicle costs. It’s designed specifically to provide automakers with the most cost-effective material to design safer and lighter vehicles. A lot of this steel and technology will be needed due to exponential growth in Electric Vehicles.

SOLAREDGE (SDGE) is based in Israel. Their SolarEdge DC optimized inverter system maximizes power generation at the individual PV module-level while lowering the cost of energy produced by the solar PV system. Since beginning commercial shipments in 2010, SolarEdge has shipped over 29.5 Gigawatt (‘‘GW’’) of its DC optimized inverter systems and its products have been installed in solar PV systems in 133 countries.

FIRST SOLAR (FSLR) was founded in 1999 and is a leading global provider of comprehensive photovoltaic (PV) solar systems using advanced module and thin-film solar panel technology. Their customers consist primarily of utilities, independent power producers, commercial, and industrial companies. Strongly financially positioned, First Solar has the platform to scale exponentially due to future robust solar demand.

APPLE (APPL) It’s no secret that Apple has been working on Project Titan comprised of automotive projects that could ultimately lead to an Apple Car. Many years have lapsed about a definitive partnership or joint venture. From a strategies standpoint, however, they would not partner with any of the legacy ICE auto manufacturers from an ESG perspective. Also, it would not be cost-effective for them to build an Apple Car in China and have them ship them to America, not to mention all the mega fossil-fuel pollution that would result from shipping from overseas. Moreover, both of these strategies run counter to their environmental goals.

Will Apple go full-blown Electric Vehicle, Solar, and Battery Energy Storage going toe to toe with Tesla right here in America? I don’t believe so. It would be too capital intensive along with significant manufacturing time build out constraints. It would take up to a decade to see anything of measurable scale. What about partnering up with the new pure EV players like Rivian or Polestar? If Apple digs deep enough, its due diligence team most likely would come to the same conclusion I did. Too much risk exposure. Would Apple use its position to make a cash and stock offer for Tesla? The sheer size of their balance sheet, cash holdings, supply chain network, engineers, and global consumer reach could further augment their consumer end products from an automotive play. It was heavily speculated back in 2018/2019 that Apple would be a good suitor however, Tesla found its footing and emerged from production hell victorious. If a tender offer was presented, Neo would be opposed to such a transaction. There is still much of Elon’s Secret Master Plans to execute on. If Apple steps in now, it could derail many future revenue multiplier channels imbued within those plans. Tesla would most likely adopt a wicked poison pill strategy to fend off such an offer.

Steel Dynamics (STLD) is the 3rd largest producer of carbon steel in the United States. They are also one of the largest metal recyclers with a broad, diversified product lineup. There are currently 275+ million ICE vehicles in the U.S. that will be of zero value which will need to be melted down and re-purposed into new Tesla’s. The unofficial numbers for Tesla’s CYBERTRUCK orders range anywhere from 1 million to 3 million. That’s a good amount of steel needed. Tesla’s Texas Gigafactory is well-positioned to source metals from Steel Dynamics. It’s Stinton Steel Mill is also located in Texas. The brilliance of the Cybertruck cannot be underestimated. Yes, looks are subjective around the Cybertruck however, there is oh so much more beyond its looks. Strategically, the Cybertruck will go down in the annals of automotive, business, and finance books as another brilliant play by Elon. The automotive world and Wall Street doesn’t see it, but we see it.

TAN (TAN) Invesco’s Solar Exchange Traded Fund – An exchange-traded fund with diversified portfolio holdings concentrated in the Solar Industry Energy Sector. Its current top portfolio holdings are Enphase Energy and SolarEdge Technologies. We believe the portfolio manager/team will be repositioning the portfolio holdings when they discover Trinity.